Managing payroll can be complex and time-consuming for small business owners.

Payroll management is essential to running a business, but it can be tedious and error-prone. Small business owners spend hours each month manually calculating employee wages, taxes, and deductions.

In addition, ensuring compliance with ever-changing tax regulations can be a daunting challenge. QuickBooks Payroll offers a comprehensive solution by automating payroll processes, simplifying tax calculations, and providing compliance assistance.

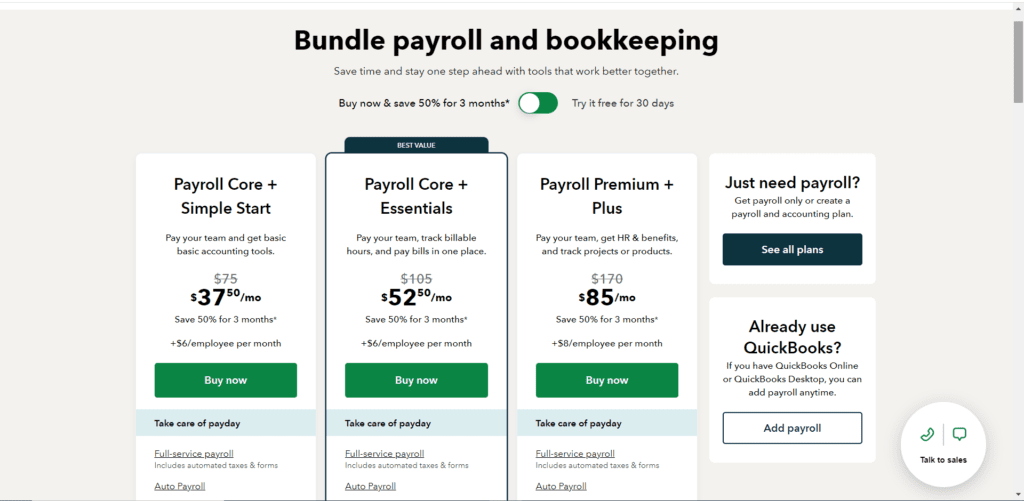

QuickBooks Payroll offers a comprehensive solution by automating payroll processes, simplifying tax calculations, and providing compliance assistance. Try it for 30 days free.

It can quickly become overwhelming, from calculating wages and deductions to complying with tax regulations. However, payroll management can be simplified and more efficient with the right tools and resources. One such tool that has gained popularity among small businesses is QuickBooks Payroll.

This article will explore how it can simplify small business payroll management, its key features, benefits for small business owners, and real-life examples of businesses successfully using it.

Table of Contents

Features of QuickBooks Payroll

QuickBooks Payroll encompasses a range of features designed to streamline the payroll management process. Some of the key features include:

- Automated Payroll Calculations: It automatically calculates employee wages, taxes, and deductions, reducing the chances of errors and saving valuable time.

- Direct Deposit: Small business owners can easily set up and execute direct deposits, eliminating the need for paper checks and reducing administrative tasks.

- Tax Filing and Compliance: It simplifies tax filing by automatically calculating and filing federal and state payroll taxes. It also provides compliance updates to keep small businesses in line with tax regulations.

- Employee Self-Service: It offers an employee self-service portal, allowing employees to access their pay stubs, view tax forms, and update their personal information, minimizing the need for administrative involvement.

- Time Tracking Integration: Seamlessly integrates with time tracking software, automatically transferring accurate hours worked for smooth payroll processing.

- Customized Payroll Reports: Generates customizable payroll reports, giving small business owners valuable insights into their payroll expenses, tax liabilities, and other data.

Benefits for Small Business Owners

Using QuickBooks Payroll can yield several benefits for small business owners. Let’s take a closer look at some of these advantages:

- Time Savings: Automating payroll calculations and processes significantly reduces the time and effort required for payroll management. Small business owners can focus on other critical aspects instead of spending hours on manual calculations.

- Accuracy and Compliance: QuickBooks Payroll minimizes the chances of errors in payroll calculations and ensures compliance with tax regulations. This helps avoid costly penalties and audits that can negatively impact small businesses.

- Cost Efficiency: By automating payroll tasks, QuickBooks Payroll helps save costs associated with hiring additional staff or outsourcing payroll services. Small business owners can handle payroll management themselves, reducing overhead expenses.

- Improved Productivity: With the time saved on payroll management, small business owners can allocate resources to more productive activities. This can lead to increased overall productivity and efficiency in the business.

- Employee Satisfaction: QuickBooks Payroll’s employee self-service portal empowers employees by giving them easy access to their pay stubs and tax information and the ability to update their personal details. This self-service functionality can enhance employee satisfaction and reduce administrative burdens.

- Comprehensive Reporting: QuickBooks Payroll provides detailed payroll reports, which can help small business owners gain insights into their payroll expenses and make informed decisions regarding workforce management and budgeting.

Case Studies: Real-Life Examples

To illustrate the benefits and effectiveness of QuickBooks Payroll, let’s take a look at two real-life examples of small businesses that have successfully implemented QuickBooks Payroll:

Case Study 1: The Cozy Cafe

The Cozy Cafe, a locally owned coffee shop, struggled with payroll management. The owner, Sarah, was overwhelmed with manual calculations and tax filing. After implementing QuickBooks Payroll, Sarah experienced significant time savings. The automated calculations and tax filing features reduced her workload and helped her comply with tax regulations.

The Cozy Café also benefited from the employee self-service portal, which allowed employees to access their pay stubs and tax forms independently.

Case Study 2: The Creative Agency

The Creative Agency, a small marketing firm, faced payroll challenges due to frequent changes in project hours and contractor payments.

QuickBooks Payroll’s integration with time tracking software helped streamline payroll by automatically transferring accurate hours worked. This feature eliminated the need for manual entry, minimizing errors and saving time.

The agency also appreciated QuickBooks Payroll’s customized payroll reports, which provided valuable insights into project-related expenses and helped with budgeting and resource allocation.

Pricing

Conclusion

QuickBooks Payroll simplifies small business payroll management by automating calculations, ensuring compliance with tax regulations, and offering valuable features such as employee self-service and time-tracking integration.

Small business owners can experience numerous benefits, including time and cost savings, improved accuracy and compliance, increased productivity, enhanced employee satisfaction, and insightful payroll reporting.

By adopting QuickBooks Payroll, small businesses can streamline their payroll processes and focus on growing their business with peace of mind.

Remember: Managing payroll can be complex, but with the right tools and resources, it can become simpler and more efficient for small business owners.